The Sol Street Journal - Issue #3

November 12, 2025

Welcome back to The Sol Street Journal. Another two weeks flew by, and - no surprise - we’ve got a lot to unpack.

Before we dive in: on October 30, we hosted our first Live on X - the Soltober Roundup. In case you missed it, here’s the recording.

Between market flips and macro noise, one truth still holds: shipping is the only alpha (Toly said it best).

Now, let’s see what’s new across the everything chain.

🩷 The New Home for TradFi

Beyond Ethereum: global brokerage infrastructure APIs leader Alpaca has integrated with Global Dollar Network, unlocking direct USDG stablecoin access on Solana.

Crypto and stock investing app Bitso brings USDT to Solana: instant entry into Solana’s DeFi ecosystem for LATAM users.

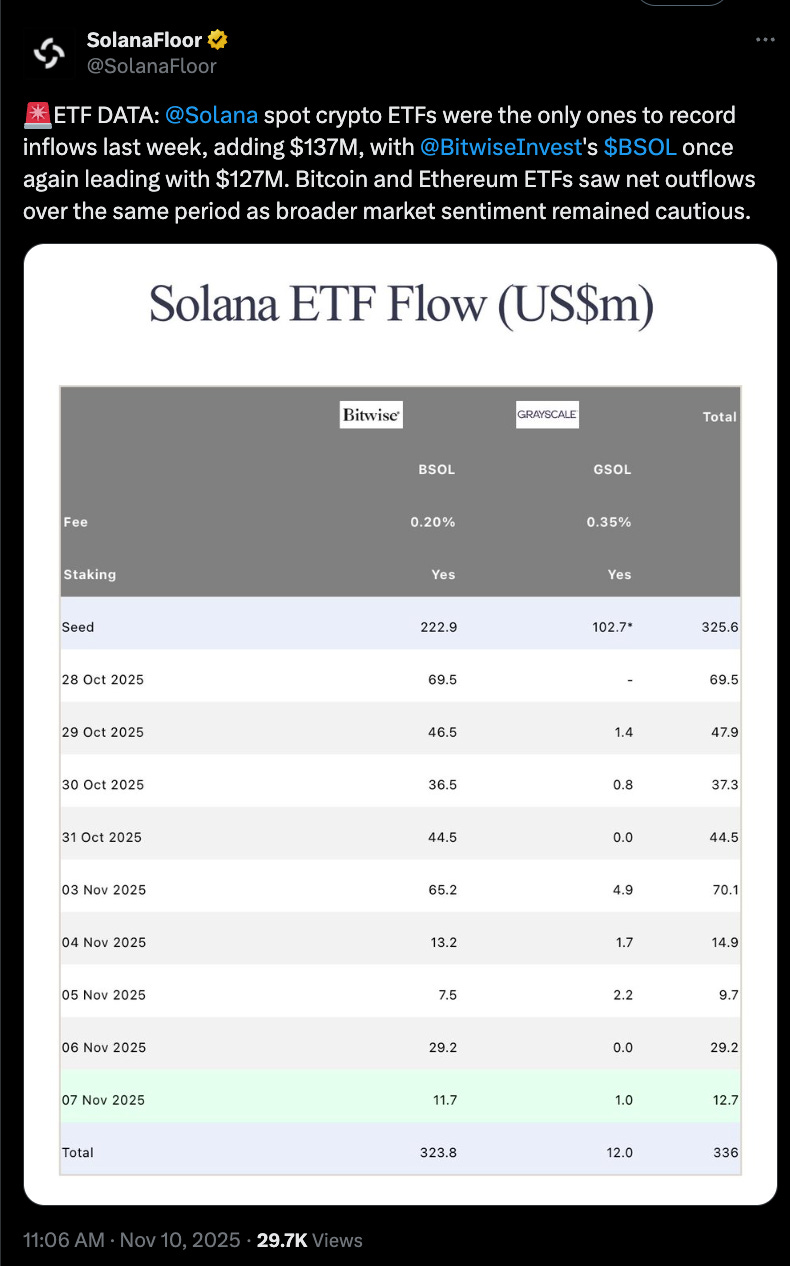

ETF data: Solana spot ETFs were the only ones recording inflows this week: +$137M total, led by Bitwise’s $BSOL at $127M. Meanwhile, Bitcoin and Ethereum ETFs saw net outflows as market sentiment cooled.

SoFi just made history as the first regulated U.S. bank to enable direct Solana purchases from checking accounts.

👑 Milestones

Solana keeps leading stablecoin inflows - topping all chains in net volume with over $150M in a single day.

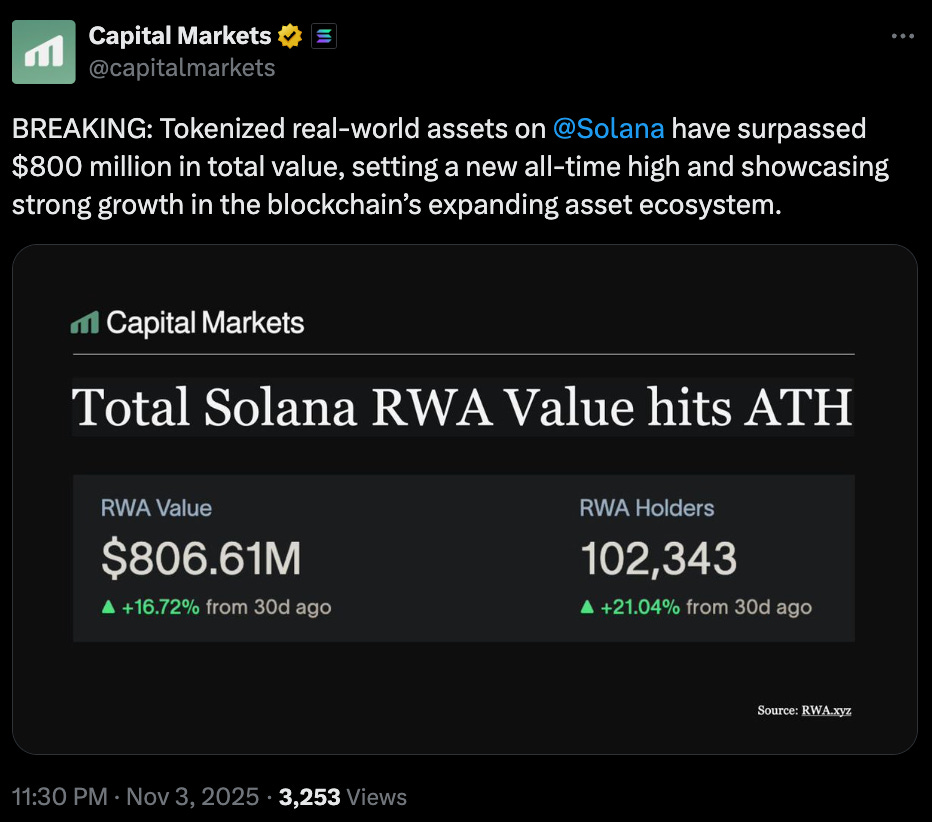

Tokenized RWAs on Solana break a new record, climbing past $800M TVL.

CME Group sets a future trading milestone: 17,400 SOL contracts traded on October 28, the biggest single-day volume of 2025.

📊 DEXs & Prediction Markets

October saw over $90M in revenue flow through Solana dApps - with Pumpfun and Axiom leading the charge.

Real-asset liquidity layer Byreal now executes native swaps via DFlowProtocol on Solana for optimized routing and settlement.

Houdini Swap adds support for Solana.

Prop AMM HumidiFi now drives nearly 35% of Solana’s DEX volume, surpassing $13 billion in weekly volume.

💧 DeFi, Payments & RWAs

Welcome, MetaMask Card: users can now pay directly with $USDC and $USDT on Solana.

Privacy-first wallet Hush with built-in ZEC bridging is launching on Solana.

Solana joins the Blockchain Payments Consortium, working toward a $10T+ unified on-chain payment layer through standardized cross-chain stablecoin transactions.

🔧 Infra

Harmonic debuts on Solana: a next-gen block-building engine driving innovative market structures and on-chain competition with CEXs.

Helius introduces gTFA (getTransactionsForAddress): a 10x faster RPC method for archival data.

Alchemy unveils a rebuilt Solana infrastructure stack, designed for institutional-scale performance.

🧠 For the Overthinkers

Handpicked collection of reports, interviews, long reads, and research - all worth your bandwidth:

Podcast - Validated: Unpacking the True Costs of Crypto Scale — A Conversation with Austin Federa and Kevin Bowers

Video Interview - SolanaFloor: Why institutions are turning to Solana with RockawayX CEO, Viktor Fischer

Podcast - Bankless: x402: The Key to Internet Money, Micropayments & The AI Agent Economy with Sam Ragsdale

Video Interview - FinTechTV: Exploring the Future of Payments and Stablecoins with Amira Valliani from Solana Foundation at Money20/20

Report - Fortune: Described as “the best ETF launch of 2025,” Solana’s spot ETFs led the next phase of crypto integration into traditional markets, with investors moving quickly to gain exposure.

That’s a wrap for Issue #3. For continuity and deeper insights, catch up on Issue #1 and #2.

Thanks for reading, we’ll see you again Wednesday, November 26: same street, new stories.

Before you head out, hit subscribe to get the next ones straight to your inbox: